AXIAN Investment applies a long-term fundamental approach to build a resilient portfolio of investments supporting the group’s goal of positive impact and shared values. Its activities, while return-driven, will back exceptional entrepreneurs transforming industries and creating opportunities across asset classes, sectors and geographies.

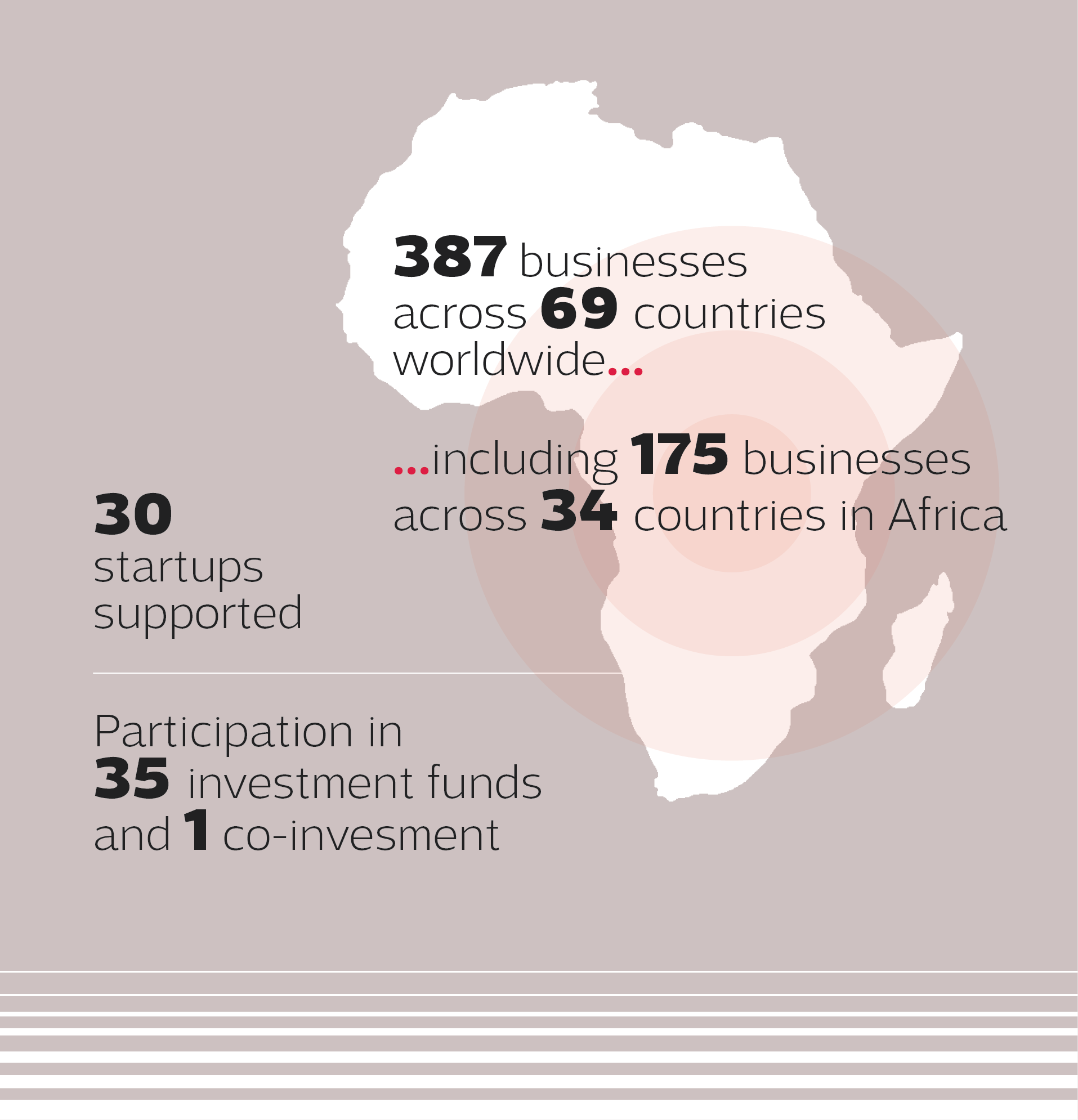

“AXIAN Investment will enable us to invest strategically in both Private Equity and Venture Capital, empowering businesses to create more value while contributing to economic growth in countries across Africa. Consolidating both branches of investment activity under one roof will allow us to reinforce our standing as the group’s lookout-point seeking innovation and opportunities across the continent. Our involvement in 77 businesses across 28 countries in Africa via both direct and indirect operations will allow the AXIAN Group to leverage this broad presence to become a first-rate, pan-African investor.”

Hassane Muhieddine

CEO of AXIAN Financial Services

Corporate Venture Capital

AXIAN Investment Corporate Venture Capital promotes actively a unique vision by supporting innovative and early-stage companies in Africa. Our investment thesis focuses on the tech-related ventures that have significant growth potential on their markets.

Our mission is to bring a different approach as a strategic partner to make the ecosystems grow on the long term. AXIAN Investment Corporate Venture Capital helps African start-ups to reach their full potential and create a sustainable cycle by positively impacting financial, digital and energy inclusion.

All

Insurtech

E-commerce

Fintech

Enterprise

Healthtech

Logistictech

Cybersecurity

Entreprise

Mobility

Agricultural insurance and technology company that designs and delivers innovative agricultural insurance, and digital products to help smallholder farmers endure yield risks.

Sector Insurtech

Country Kenya

Wholesale player re-engineering the retail market using proprietary technologies, innovative supply chains, and embedded finance solutions designed to empower both retailers and suppliers.

Sector E-commerce

Country Egypte

Buy Now Pay Later operator allowing consumers to purchase goods and services by paying in monthly.

Sector Fintech

Country Kenya

E-commerce platform for small and medium retailers allowing easy ordering & financing for daily products.

Sector E-commerce

Country Nigeria

Neobank in Francophone Africa fully digital suite of banking services through a user-friendly app.

Sector Fintech

Country Côte d'Ivoire

Payroll, benefits, compliance software company with embedded finance for local and remote teams in Africa.

Sector Enterprise

Country Kenya

Buy Now Pay Later offering quick, easy & affordable access to loans without collateral to merchants.

Sector Fintech

Country Egypte

Healthcare and telemedicine platform for companies to offer healthcare services to their employees.

Sector Healthtech

Country France

Cross-border e-logistics technology providing a digital platform for logistics workflows, end-to-end visibility and credit financing.

Sector Logistictech

Country Ghana

Aggregator of cross-border and remittance platforms helping users to compare various options, pay and send money within a single app.

Sector Fintech

Country Nigeria

Mobile application for telehealth services with online consultations and healthcare-related social network.

Sector Healthtech

Country Cameroun

E-commerce platform for FMCG products in Francophone Africa offering a wide range of services & products, including financing solutions.

Sector Logistictech

Country Maroc

One-stop shop payment platform for SMEs providing loans, business tools and financial services.

Sector Fintech

Country Nigeria

Integrated and reliable pharmaceutical marketplace, providing a data-driven solution for our customers that enhances the efficiency and effectiveness of their ordering processes.

Sector Healthtech

Country Egypte

Tanzanian health tech, offering a dependable pharmaceutical marketplace with fast delivery, revolutionizing medical logistics with an experienced team and an ‘asset-light’ model.

Sector Healthtech

Country Tanzanie

Logistic platform-based technology improving delivery processing and first, middle, last miles delivery chain in Egypt and Saudi Arabia.

Sector Logistictech

Country Egypte

Digitizing credit collection using machine learning and digital communication channels to improve Non-Performing loans for banks, microfinance institutions and fintechs.

Sector Fintech

Country Nigeria

Integrated lending platform for 2 and 3 wheels light Electric Vehicle embarking a disruptive scoring engine and a loan management system

Sector Fintech

Country Inde

Tailored liquidity solutions for mobile banking services, short-term micro loans and longer-term facilty for agents, merchants and end-consumers.

Sector Fintech

Country Tanzanie

Digital insurance broker offering omni-channel strategy, online platform, tailored products.

Sector Insurtech

Country Côte d'Ivoire

A licensed digital bank simplifying direct access to international payments through an innovative platform and APIs.

Sector Fintech

Country Royaume-Uni/Nigéria

Building a payment infrastructure unifying all payment methods with unparalleled success rates (98%) across Francophone Africa.

Sector Fintech

Country Côte d'ivoire

End-to-end SaaS platform that centralizes payment data from all key payment stakeholders and automates processes to remove blind spots and reduce manual effort

Sector Fintech

Country Maroc

Digital infrastructure for agent networks (telco, cash points) across Africa, with access to capital and financial services

Sector Fintech

Country Ouganda

Leading Arabic-focused conversational AI chatbot building platform in the MENA region

Sector Enterprise

Country Egypte / KSA

Cybersecurity company that provides AI-powered endpoint security solutions using Zero-Trust architecture

Sector Cybersecurity

Country Maroc

AI-powered insurance infrasructure for claims processing and fraud management

Sector Insurtech

Country Nigeria / UK

Provide a platform for cargo owners to find and book vehicles, and for vehicle owners to find and manage cargo

Sector Logistictech

Country Kenya

Digital bank for Africa’s workforce – Help workers access their earnings, save and invest, qualify for loans, and enroll in insurance through a single digitized platform

Sector Fintech

Country Kenya

Cross-border payments in emerging markets offering multi-currency accounts at regulated banks and fintechs, 24/7 real-time FX using a unique infrastructure that merges banking and blockchain systems

Sector Fintech

Country Israel

Solutions for data management, focusing on security and compliance through innovative database technologies

Sector Entreprise

Country Tunisia

African mobility and fintech platform that empowers drivers to own their vehicles through an accessible drive-to-own model

Sector Mobility

Country Angola

FUND OF FUND

The EuroMena Funds is one of the MEA region’s leading private equity firms specialized in emerging markets

Emerging Capital Partners (ECP) is one of the oldest and largest private equity firms established in 1999 to invest in high-growth companies in Africa and related markets

Adenia makes values-based investments in promising companies across the continent and takes responsibility for guiding them to sustainable growth.

Amethis is an impact-oriented private equity firm focusing on financial, environmental and social sustainability.

Backing champions of African tech since 2017, the Africa team seeks the next generation of category leaders across the continent.

Based in Paris and New-York – is a technology investment firm committed to investing differently.

DPI generally seeks to invest in fast-growing companies operating in high-growth sectors across Africa.

Actis is a global investor in sustainable infrastructure and aims to deliver competitive returns for investors and positive impact for communities in which it operates.

Disruptech has been actively investing in Egyptian early-stage tech startups since 2021. Disruptech invests in great teams with disruptive solutions to the traditional finance space.

Based in Paris and New-York – is a technology investment firm committed to investing differently.

Spotting, backing, and working with exceptional founders from the very beginning of their journey is the shared passion and sole focus of the Partech Seed team, since 2013.

Since 1999 TLCom has supported innovative entrepreneurs that leverage technology to find market solutions to significant challenges.

KKR is a global investment firm investing across private markets in every asset class all over the world.

Wellington is one of the world’s largest privately held asset managers, allowing it to take the long view, innovate, and invest when others pull back.

Argos is an independent European private equity group that supports the growth of mid-sized businesses and backs their management teams.

C4 Ventures is a leading European Venture firm led by former Apple and Microsoft executives, a team of business operators backing ambitious tech entrepreneurs.

EQT is an investment organization committed to creating value by finding good companies and helping them become the most promising builders of tomorrow.

Trail Capital supports European entrepreneurs by bringing them the benefit of its Euro-chinese resource platform and its experience as industrialists and investors.

Pamoja Ventures is a venture capital firm that seeks to back the next generation of African entrepreneurs.

Two angel investors, 14 countries explored, and 18 months to dive into the unique African business landscape—that’s Kara Ventures.

Awz Ventures, founded in 2016 by Yaron Ashkenazi, is an investment firm focused on innovative security and intelligence technologies to protect people and companies globally, leveraging the expertise of its partners and advisors.

A new growth equity partner for the best founders in Latin America. Bicycle Capital seeks innovation that empowers, includes, and endures. Just like a bicycle.

In 2017, Maor’s founders identified the opportunity to set up a co-investment fund that would invest in revenue-generating tech companies, as well as connect European investors and corporates to Israeli innovation.

African Infrastructure Investment Managers (AIIM) develops and manages private equity infrastructure funds designed to invest long-term institutional unlisted equity in African infrastructure projects.

Lighthouse Canton is a global investment institution offering wealth and asset management services.

First Circle Capital supports founders building transformational companies. It invests in pre-seed and seed stage FinTech companies across Africa.

Berkshire Partners seeks to invest in growing companies and help them become enduring market leaders.

Since 2018, Saviu has been backing talented entrepreneurs building category-defining tech-enabled companies in Francophone Africa, and across the continent.

Apis, founded in 2014 by Matteo Stefanel and Udayan Goyal, invests in high-growth, tech-enabled financial services companies globally, leveraging innovation to improve lives worldwide.